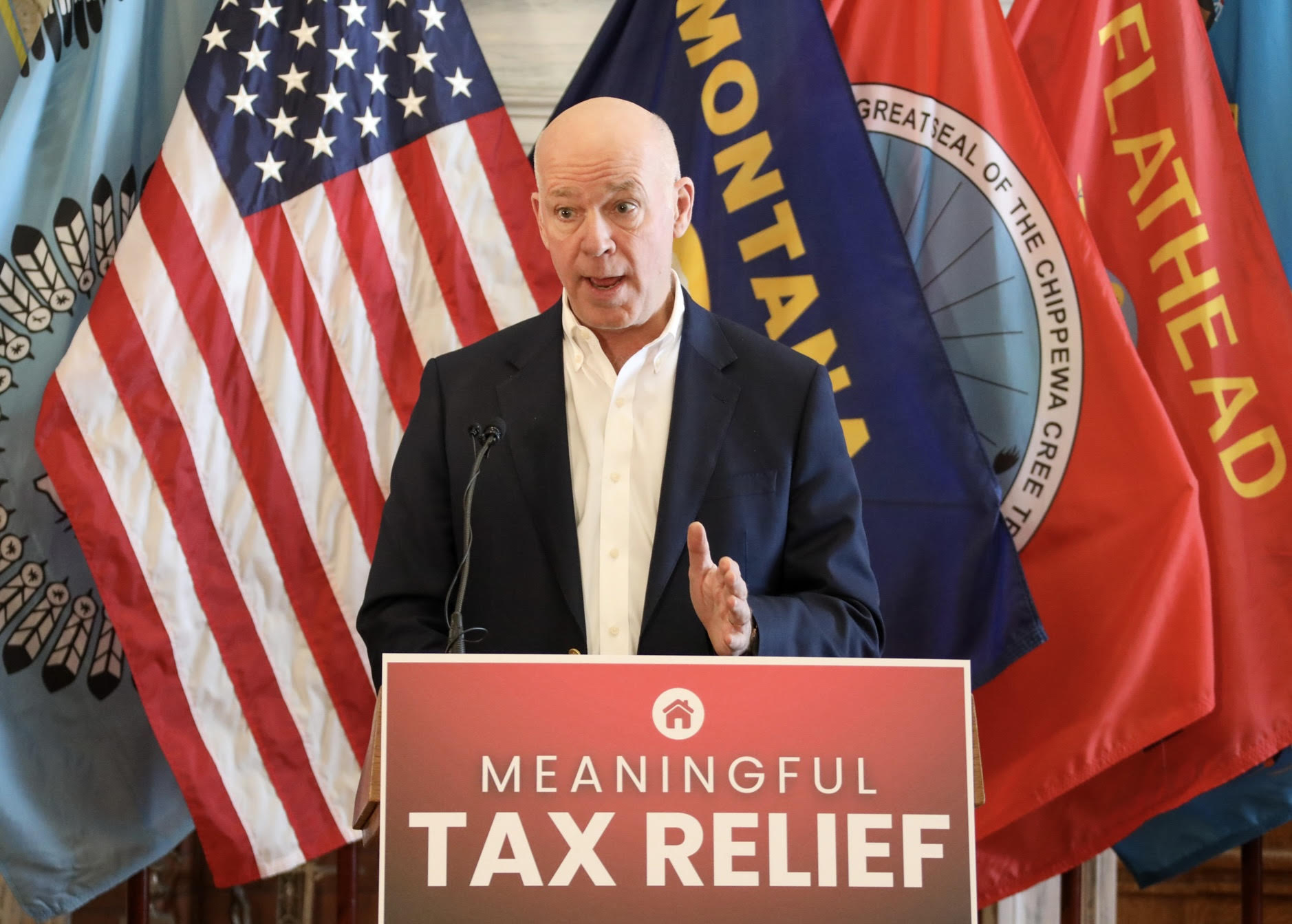

HELENA — Governor Greg Gianforte announced Tuesday that 80 percent of Montana residential property owners received a property tax cut in 2025—but one in 10 homeowners still saw increases, underscoring how local government spending decisions can override state-level reforms.

“For years, Montanans have said property taxes are too high, and they’re right,” Gianforte said. “Our focus has been securing meaningful, long-term property tax relief for Montanans in the place they call home, and we’ve delivered. The data make it clear that these reforms are a win for Montana homeowners.”

According to the governor, the Montana Department of Revenue reports^1 that nearly 80 percent of homes saw a tax cut from the reforms, with about 10 percent seeing property taxes remain flat. The remaining 10 percent of homeowners saw property tax increases despite the state-level reforms.

According to the governor, the average savings for homeowners who received a tax cut was more than $500, not including the up to $400 property tax rebate available to eligible homeowners.

The gap between homeowners who benefited from state reforms and those who still saw increases highlights the role local government spending decisions play in determining final tax bills.

How the Reforms Work

Senate Bill 542^2, carried by Senator Wylie Galt, R-Martinsdale, established tiered tax rates aimed at delivering property tax relief for homes, small businesses, farms, and ranches in 2025. The bill also provided a property tax rebate for primary residences.

This year, more than 235,000 Montana homeowners claimed and received the property tax rebate. Those homeowners may be automatically enrolled in the Homestead Rate for 2026, provided they did not move or change ownership in 2025.

House Bill 231^3, carried by Representative Llew Jones, R-Conrad, established the Homestead Rate, which takes effect next year. The Homestead Rate is a new, lower property tax rate for long-term rentals and primary residences.

The reform was recommended by the governor’s bipartisan Property Tax Task Force.

Local Jurisdictions Drive Tax Bills

Property taxes are largely a function of local jurisdictions, the governor’s office noted, with approximately 80 percent of property tax revenue from residential homeowners going directly to local governments and the remaining 20 percent going to the state, which returns the amount in full to help fund K-12 public schools.

Some Montana jurisdictions chose to increase property taxes despite windfall revenue from surging home valuations. Missoula County commissioners approved an 8% property tax increase^4 for fiscal year 2026 in September, generating $4.6 million in additional revenue.

When Missoula County property tax bills arrived^5 in October, they reflected increases from both the county and city, with at least one homeowner seeing increases despite the state reforms.

The gap between homeowners who benefited from state reforms and those who still saw increases highlights the role local government spending decisions play in determining final tax bills.

Opposition From Business Groups

During the legislative process, the property tax bills faced significant opposition from business and agricultural groups who argued the bills weren’t really offering tax relief, just changing who pays property taxes^6 — shifting the burden to companies, farms and ranches.

“These bills today are adding complexity to an already incredibly complex system and adding cost to investment in the state,” said Todd O’Hair, president and CEO of the Montana Chamber of Commerce, during legislative hearings in April.

Lawmakers backing the plan argued the changes would rebalance the tax system to adjust for the greater burden residential properties experienced since 2023, due to spiking property values.

What’s Next

Homeowners will need to apply to claim the Homestead Rate starting in December 2025. However, anyone who applied for and received the property tax rebate in 2025 will automatically qualify, unless their home has changed owners or is no longer their primary residence.

More information about the Homestead Rate is available at homestead.mt.gov.

Comments

2 responses to “Governor Says 80% Got Tax Cuts, but 1 in 10 Homeowners Still See Increases”

Places like Missoula are “black holes” where Taxpayers can never give enough. Most residents are either complacent or supportive of the spending. It’s a hot mess.

AMEN! MO has too many liberals who want the government to take care of them rather than they take care of themselves. The legislators from that area are a bunch of poorly educated Democrats who don’t know the forest for the trees and they vote NOT for the good of the people but the good of the party and the caucus to which they belong. We ahve the same issue here in RAVALLI COUTY 45 miles south of MO. Legisaltors who are self serving and do NOT serve the people. It also has the head of the committee that did cut taxes for 80% of people, David Bedey, and got them a $400. tax break. Homeowners especially older citizens need protection from government spending such as giving one million dollars to the Rocky Boy reservation in 2013 to preserve the culture and language of the tribe. I support the idea BUT…not when the FEDS were also sending them money at the same time for the same purpose! Their teachers meanwhile were on DONORS CHOOSE begging for money for paper and pencils. This is one tribe whose legislators needs to be watched like ahawk – just like the ones from MO! We need to watch what our state leigslature is doing when it comes to spending. However, this author needs to look at these charts prepared put out by the Montana Free Press – these might help you see why Bedey and his committee did the best they could WITHOUT resorting to a sales tax. https://montanafreepress.org/2025/11/26/6-charts-showing-how-montanas-big-legislation-shifted-2025-property-tax-bills/