BOZEMAN — A Montana law firm is challenging the state’s property valuations in more than 100 appeals, citing what it calls systematic problems with the Department of Revenue’s latest assessment cycle that could result in inflated tax bills for property owners across the state.

Silverman Law Office announced it is appealing over 100 state property appraisals, with attorney Joel Silverman — a former Department of Revenue tax attorney — claiming the state’s valuation process contains recurring technical errors that particularly impact higher-value properties.

“Many of these valuations are far too high, which means property taxes are going to be far too high if left unchallenged,” said Silverman, who spent six years working as a tax attorney inside DOR. “I’ve seen the internal process, and I know how flawed the system can be.”

Record Number of Appeals

Independent appraisers are confirming widespread problems with this assessment cycle. Shaun Moore, a Helena-based certified appraiser with Moore Appraisal Firm, said property owners are questioning their tax assessments at unprecedented levels.

“More so this cycle than ever in my 24 years of being an appraiser,” Moore said when asked about appeal volume.

Moore said state valuations in his area have increased dramatically — often 50% to 60% from the previous cycle — citing “market appreciation” as justification. However, he questions whether these increases reflect actual market conditions.

“This last cycle seems much higher. I’ve seen values this cycle increase 50 or even 60% from the last cycle in my area, which isn’t accurate from what I’ve seen over the past 2 years,” Moore said.

Technical Problems Identified

Working with third-party appraisers, Silverman Law Office identified several recurring issues in the state’s property valuations:

Inaccurate square footage measurements affecting property values

Inappropriate use of cost approach when market approach would be more suitable

Failure to consider unique property characteristics that affect market value

These technical errors can contribute to significant tax increases, according to Silverman, especially for properties valued over $1 million.

“The Department of Revenue’s flawed process is leading to inflated values and unfair tax bills for property owners across Montana,” Silverman said. “The numbers often don’t reflect reality, and the financial impact can be significant.”

Appeal Challenges

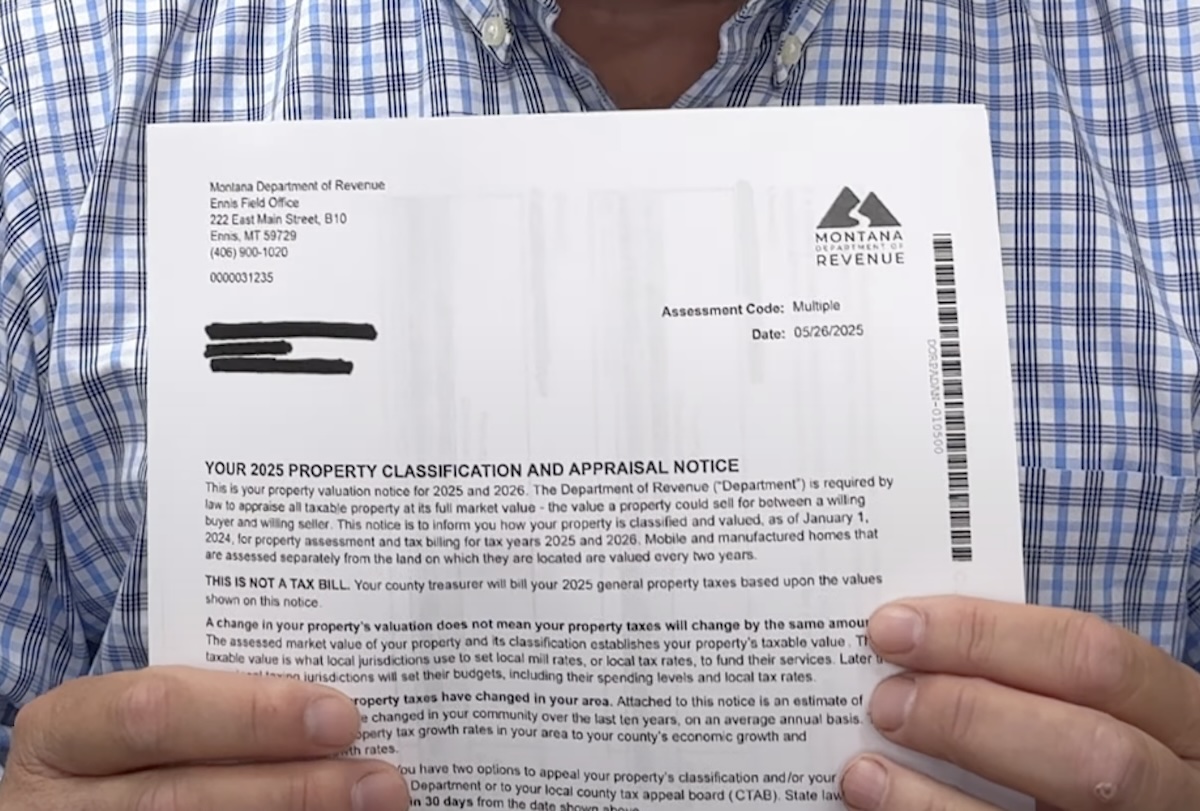

Property owners face a strict 30-day deadline to challenge their valuations, with many appraisal notices dated July 25. Missing this deadline means accepting the state’s assessment.

Moore said the timeline creates practical problems for property owners who need professional help to gather comparable sales data — information that’s difficult to access in Montana, a non-disclosure state where sale prices aren’t part of any free public database and are generally only available through real estate professionals of paid county record searchespublicly available.

“It feels like a tight timeframe,” Moore said. “If people have to rely on professionals to get the data they need to appeal I could see there being a delay.”

The state has access to all property sales data while independent appraisers are limited to what’s reported through multiple listing services, Moore explained. For commercial properties, the Department of Revenue doesn’t share the data it uses for valuations, making appeals more challenging.

Data Access Disparity

Montana’s status as a non-disclosure state creates an information imbalance between the Department of Revenue and property owners seeking to challenge their assessments.

“They have access to every sale and we’re generally limited to what’s reported in the MLSs,” Moore said. “I’ve requested data from them on an appeal for a commercial property before and got a response that they don’t share the data they use for commercial properties, only residential.”

Moore provides valuation reports to help property owners with appeals, finding comparable sales and putting them into formats clients can use. His wife Jessica Moore, a broker, provides similar market analysis reports.

“It’s my understanding that you don’t need the appraisal, or market analysis like my Jessica does, but I don’t know how else the general public would come up with the sales, again because Montana is a non-disclosure state and the public doesn’t have access to MLSs,” Moore said.

Historical Context

The assessment problems represent a shift from previous cycles. Moore noted that prior to this round, state valuations were “generally lower than market value” with the previous cycle being “one of the more accurate.”

This latest cycle’s dramatic increases contrast with Montana’s recent property tax relief efforts. In April, the state encouraged property owners to apply for programs that reduce tax rates by 30%, 50%, or 80% on properties valued up to $350,000.

Governor Greg Gianforte’s administration has touted $120 million in long-term property tax relief and recommended additional cuts for the 2025 Legislative Session.

State Response After Initial Deflection

Western Montana News initially sought comment from the Montana Department of Revenue on the specific valuation accuracy claims and the appeals process, asking how it ensures accuracy in property valuations, typical appeal volumes and success rates, whether systematic issues exist in the current cycle, and how the current process compares to previous years.

Communications Director Jason Slead initially directed the inquiry to a general information request email, then Public Information Officer Sheila Stevens referred the reporter to the Office of Public Information Requests (OPIR), citing Montana Senate Bill 232. However, OPIR is tasked with fulfilling public records requests, not handling requests for comment from members of the media for public officials. OPIR’s own guidelines state that it “does not answer questions for agencies” and that “questions for agencies are best directed to them.”

When the reporter pointed out this contradiction, DOR maintained its position of directing media inquiries through the formal records request process rather than providing comment on the valuation accuracy allegations.

After publication of this story, Slead provided a detailed response defending the department’s valuation process and disputing claims of systematic problems.

DOR Defends Valuation Process

The department said it ensures accuracy through multiple testing stages and meets International Association of Assessing Officers (IAAO) standards, maintaining sample appraisal levels within 10% of market value.

“The reappraisal also meets uniformity standards on a statewide level,” Slead said. “Appraisal staff perform a final determination of value, carefully analyzing and selecting the most appropriate valuation method—whether the cost approach, the comparable sales approach, or the income approach.”

The department disputed the scope of appeal problems cited by Moore and Silverman. According to DOR data:

- 2023 cycle: Out of approximately 813,000 properties, about 20,600 property owners (2.5%) filed informal reviews, with only 0.08% proceeding to County Tax Appeal Boards

- 2021 cycle: A total of 10,455 appeals were filed across all levels, representing 1.3% of total properties

“The department has not identified any systematic issues in the current reappraisal cycle,” Slead said. “We will continue to monitor for potential concerns as additional appeals are received and reviewed.”

The department directs property owners with concerns to visit its websites, Property Assessment Division (property.mt.gov) or Montana Cadastral (cadastral.mt.gov), to review their property characteristics and confirm accuracy. Property owners can file an informal review if they find inaccuracies, and an appraiser will contact them to schedule a property review. Owners can also visit local field offices to review valuation details with an appraiser before deciding whether to file an appeal.

Conflicting Data on Value Increases

DOR’s statewide data conflicts with Moore’s local observations. The department reported a 22% statewide median value increase for 2025, significantly lower than the 47.2% increase recorded in the 2023 cycle.

However, Moore’s experience in the Helena area suggests much higher increases of 50-60% in his market, indicating potential regional variations in valuation accuracy.

Silverman, drawing on his experience inside the department, said he hopes officials will examine their valuation methods.

“I hope the Department of Revenue takes a serious look at how it handles valuations in the future,” Silverman said. “Because right now, their approach isn’t working, and it’s costing Montanans.”

Property owners who received appraisal notices dated July 25 have until August 24 to file appeals. More information about the appeal process is available on the Department of Revenue’s website.