MISSOULA COUNTY — The Missoula County Clerk and Treasurer’s Office is warning residents about property tax payment scams that officials say have been circulating in the area, using government terminology and alarmist language to deceive property owners.

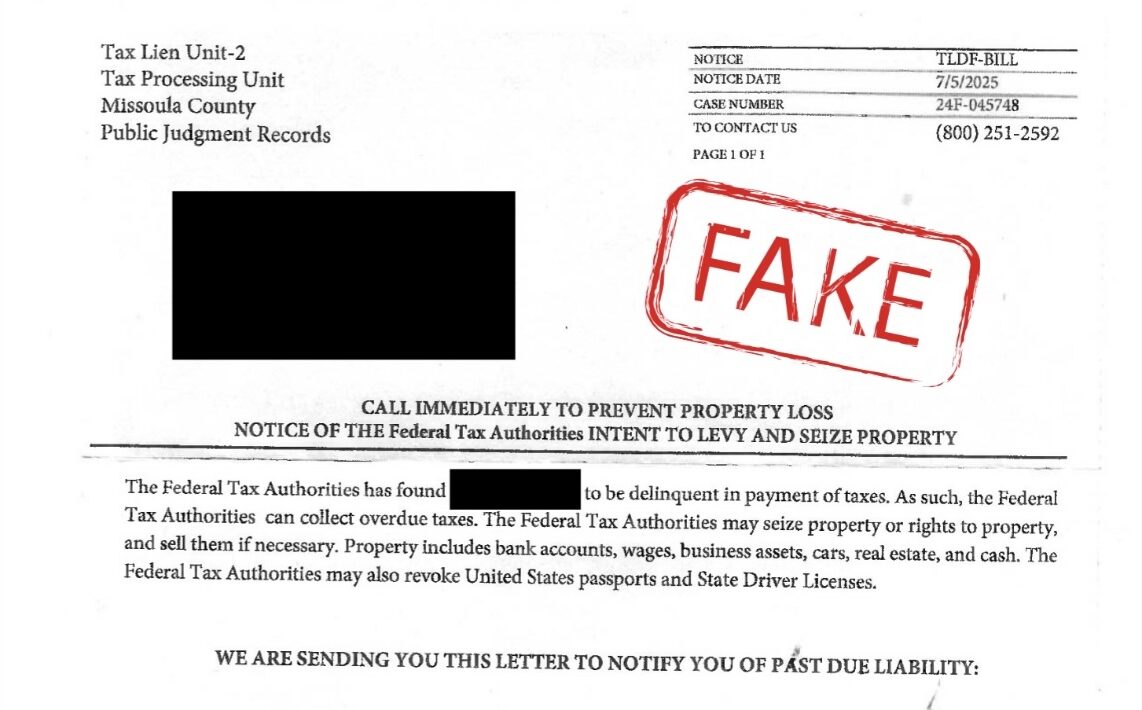

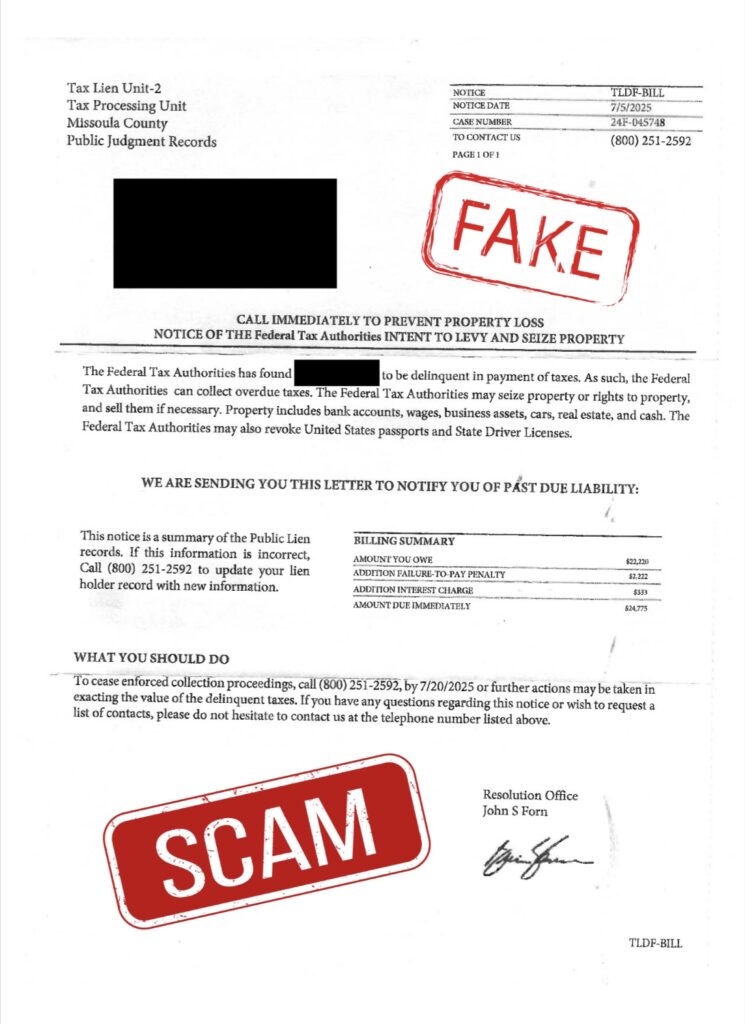

According to county officials, residents have reported receiving fraudulent letters and phone calls claiming they are delinquent on property taxes and threatening property seizure if immediate action isn’t taken by a stated deadline.

The scam communications often include publicly available property information to appear legitimate and typically provide an 800 number for recipients to call. When residents call these numbers or receive unsolicited calls, scammers attempt to coerce them into providing payment information over the phone.

How to Identify Legitimate Communications

The Clerk and Treasurer’s Office does send official letters to property owners regarding delinquent tax payments or other property issues, but legitimate communications will always include:

- The correct office address: 200 W. Broadway

- The correct phone number: 406-258-4747

- No 800 numbers will be listed on official correspondence

County staff typically only make phone calls to taxpayers who have previously contacted the office via phone or email.

Protecting Yourself

County officials advise residents who receive suspicious letters or phone calls about delinquent tax payments to contact the Clerk and Treasurer’s Office directly at 406-258-4747 before making any payments or providing personal information.

The office has made a sample of the fraudulent correspondence available for residents to review and compare against any suspicious communications they may receive.

Red Flags to Watch For

Residents should be particularly wary of communications that:

- Use urgent, threatening language about immediate property seizure

- Provide only 800 numbers for contact

- Request immediate payment over the phone

- Include personal property information but lack official county contact details

Property owners who have questions about the legitimacy of any tax-related communication are encouraged to verify directly with the county office before taking any action.