MISSOULA — Missoula County property tax bills mailed today reflect the significant tax increases Western Montana News reported throughout the summer and fall, with at least one homeowner seeing her modest home’s tax bill jump 22% in a single year.

The 2025 property tax bills, now available online, arrive with the 8% county property tax increase commissioners approved in September and city tax increases that officials claimed would provide “tax relief for most homeowners” while actually increasing total city property tax revenue by $2.4 million.

“Just to ruin your day, you can visit the Missoula county government website Property Information System to see the damage our local elected officials have inflicted,” wrote one reader to Western Montana News. “For my modest 2-bedroom, 50-year old home, I’m taxed $7,218. Last year was $5,905. Words fail.”

The reader’s 22% increase far exceeds the county’s 8% overall tax hike, illustrating how individual property tax impacts vary significantly based on assessed value changes and location within city limits.

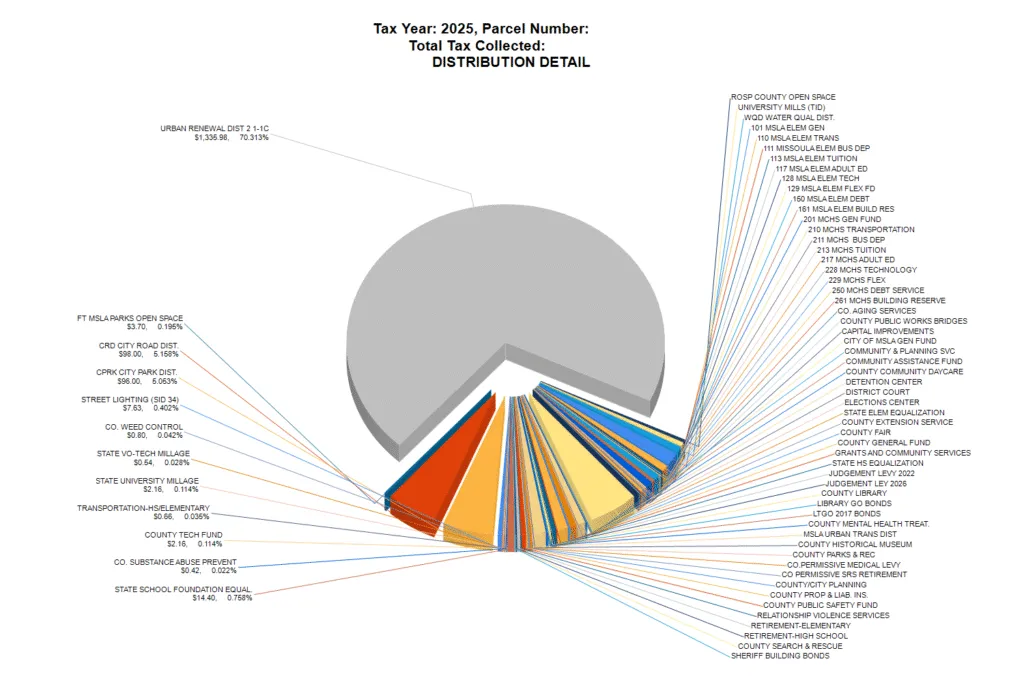

Another reader living downtown reports that Urban Renewal District II consumes 70% of their total property tax bill. The district, which encompasses the West Broadway Corridor, the Old Sawmill District and the central neighborhood, uses tax increment financing to fund what the city calls “public improvements” and private development incentives until its sunset date of June 30, 2031.

Dozens of Hands in Property Owners’ Wallets

Urban Renewal Districts like District II are geographic areas where the Missoula Redevelopment Agency, a separate tax spending agency with little oversight from the City Council, uses Tax Increment Financing (TIF) to capture property tax revenue that would otherwise go to schools, the county, and other jurisdictions. This mechanism allows the MRA to fund projects they choose within the district boundaries using diverted tax dollars. The MRA operates with significant independence from the City Council, making spending decisions on projects that can extend beyond city limits without direct council oversight.

TIF funds are generated from the difference between the value of an improved property and the frozen base value. The “frozen base value” is the assessed property value when the urban renewal district was created—that’s the “frozen-in-time amount.” Property taxes on this base value continue going to regular taxing jurisdictions like schools and the county. However, all property taxes on value increases above the frozen base—the “increment”—get diverted to the MRA instead.

For example, if a property was worth $100,000 when Urban Renewal District II was established but is now worth $200,000, schools and the county only receive taxes on the original $100,000. The MRA captures all taxes on the $100,000 increment, which explains how urban renewal districts can consume 70% of individual tax bills while other jurisdictions receive proportionally less funding.

The pie chart breakdowns available in the county’s dashboard reveal the complexity of Montana property taxation, with approximately 70 different jurisdictions and funding sources drawing from individual property tax bills. Beyond the major jurisdictions like the county, city, and school districts, property owners fund everything from Bitterroot Trail lighting projects ($1.6 million) to various special districts providing fire protection, water, sewer, and transportation services.

Multiple Jurisdictions Drive Higher Bills

Property owners across Missoula County face tax increases from multiple jurisdictions simultaneously. The county’s $4.6 million property tax increase primarily covers personnel costs, while the city adopted a budget with a $2.5 million deficit that still generates millions more in property tax revenue.

Western Montana News reported in September that Missoula County chose to increase property taxes while Flathead County—serving a nearly identical population—reduced property taxes for fiscal year 2026. The contrasting approaches highlight different philosophies toward government spending, with Missoula County spending $2,235 per resident compared to Flathead County’s $1,211 per resident.

Personnel expenses consume 58% of Missoula County’s property tax revenue, with the county employing 831 people at an average annual salary of $56,527. Combined with city and school district employees, government entities represent one of the largest employment sectors in the county.

Property owners who don’t pay taxes through their mortgage have until Dec. 1 to pay the first half of their 2025 taxes, with the second half due June 1, 2026.

The county accepts payments online, by mail, or through a drop box at the courthouse. Online payments by electronic check are free, while credit and debit card payments include service fees.

Tax bills are available online at missoulataxes.us, where property owners can also view pie charts showing how their taxes are distributed among the dozens of jurisdictions.

Comments

2 responses to “Missoula Property Tax Bills Arrive With Promised Increases From County and City”

https://www.ci.missoula.mt.us/86/Missoula-Redevelopment-Agency

Call the people in charge of the MRA & respectfully but sternly tell them how you feel about tax increases & wasteful spending.

Western MT News, a small constructive criticism, name names when you write an article, for example this article should provide Ellen Buchanan’s name & a website or phone on how to contact her for questions or inquiry from we the taxpayers.

Always name names so that the Liberals who waste our tax dollars have some sort of responsibility for their actions.

But yet people keep voting for the same destructive so called government back into office. As well keep voting for their pet projects every single time. I like to ask them how’s that equality working out for them now.

Keep doing the same insanity over and over and you will get even more insanity from the circus 🎪.